What is REITs(Real Estate Investment Trusts)?

Real Estate Investment Trusts; REITs

Investment is always associated with risk, and more

profitable investments have higher risks. But the real estate market is one of

the least risky but most profitable options for investors. A real estate

investment fund is a business unit that buys, creates and manages a portfolio

of real estate-based assets in order to make a profit. The profits from this

investment portfolio are distributed among the shareholders of the Real Estate

Fund.

REITs are real estate companies that operate on the stock

exchange and sell shares to people. But these companies have two main features:

1 - Manage a set of assets (land, tower, store, etc.).

2 - A large part of the profits are distributed among

shareholders (for example, 75 or 90%).

.

REITs were first created in the United States in 1961, when

the Congress passed a law allowing investors to buy and trade stocks of

mortgages and real estate, as well as other assets on the stock exchange. . On

January 1, 1961, the Supplement to the Tax Law provided for special tax

benefits for this new type of investment company. According to the supplement,

if real estate investment funds meet certain conditions, their dividends will

be tax-exempt. That is, if a REITs distributes 100% of its profits, it has no

obligation to pay taxes to the government. The law was passed to provide all

investors with the opportunity to invest in a diverse portfolio of real estate.

With the passage of this law, it became possible to invest in real estate

assets by buying and selling securities.

Since then, the funds have been set up in most countries

around the world. The value of the global REITs market in 2016 was 1.1

trillion, according to the National Real Estate Association (NAREIT). About 66%

of the funds are distributed in the United States, followed by 7.2% in Japan,

7% in Australia and the rest in the rest of the world.

Types of REITs:

- Equity REITs

They buy and manage real estate. These funds are engaged in

a wide range of activities such as leasing, maintenance, real estate

construction and service delivery to tenants. The main difference between these

funds and real estate operating companies (REOCs) is that they are used to buy

or build equipment for maintenance, management, and ultimately to earn money

(mostly rent), not for sale.

- Mortgage REITs

Most of their capital portfolio includes direct investment

through lending to real estate owners and real estate companies (REOCs) or

indirect investment through the purchase of mortgage-backed mortgages or

securities.

- Hybrid REITs combined real estate investment funds

Its investment portfolio includes real estate and financial

assets.

Some of the most important areas of activity of these funds

are:

- Retail REITs

- Residential REITs

- Hospital REITs

- Office REITs

- REITs Hotels

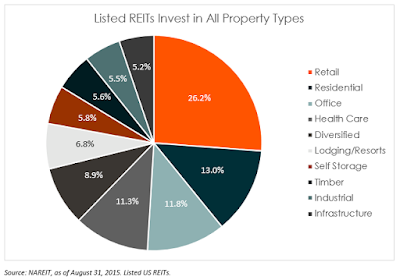

For example, retailers' RITEs, which account for the largest

share of the market, are called REITs that operate in the real estate and

department stores. The figure below shows the share of each type of housing and

real estate investment fund, whose information is taken from the S&P index

of the US stock market.

Advantages of investing in REITs:

- Tax benefits: If legal requirements are met, REITs

dividends are exempt from corporate taxes.

- Liquidity: REITs stocks are highly liquid, especially if

listed on the stock exchange.

- Variety of investment: REITs allow you to invest in

non-residential real estate such as hotels, shopping malls and other commercial

and industrial real estate.

- Professional Management: By investing in REITs, investors

benefit from professional management to manage the portfolio of real

estate-based assets.